april 2016 service tax rate

The purpose of this notice is to inform. 150000- in further appeal Appellate Tribunal determined tax liability of Rs.

Taxation In India Indirect Tax Financial Management Income Tax

The rates below apply to tax underpayments of income and excise taxes including.

. And the minimum present value transitional rates for March 2016. The sales tax rate on food is 4. Updates for the corporate bond weighted average interest rate for plan years beginning in April 2016.

Interest Rates on Tax Underpayments Interest Rates Tax underpayments will have interest applied to them daily. Credit card services may experience short delays in service on Wednesday February 23 from 700 pm. See 2017 instructions for more.

And the minimum present value transitional rates for March. Naturally estimated revenues may vary considerably depending on the tax rate but also on the assumed effect of the tax on trading volumes. Interest Rates for NYC Income Excise.

1st Quarter effective January 1 2016 - March 31 2016. An official study by the European Commission suggests a flat 001 tax would raise between 164bn and 434bn per year or 013 to 035 of GDP. A few products and services such as aviation fuel or telecommunication services have different tax rates.

In 2016 MPAC updated the assessed values of Ontarios more than five million properties to reflect the legislated valuation date of Jan. A marginal tax rate is the tax rate on income set at a higher rate for incomes above a designated higher bracket which in 2016 in the United States was 415050. GST went live in 2016 and the amended model GST law passed in both the house.

There were no sales and use tax county rate changes effective April 1 2016. Tax Laws Before the Implementation of. Hawaii County Surcharge on General Excise Tax and Rate of Tax Visibly Passed on to Customers Effective January 1 2020.

6 April 2004 Inheritance Tax nil rate bands limits and rates IHT400 Rates and tables The Inheritance Tax nil rate band and interest rates are subject to change. If the tax rate is increased to 0. Harris County Flood Control District Public Effective Tax Rate Notice Harris County Hospital District Public Effective Tax Rate Notice Harris County Port of Houston Authority Public Effective Tax Rate Notice.

Corporation Income Tax Return. Assessments updated for the 2016 base year were in effect for the 2017-2020 property tax years. For all transactions under Central Excise and Service Tax use the Tab ACES CEST Login.

2017 Instructions for Form 1120. For income below the 415050 cut off the lower tax rate was 35 or less. The funding transitional segment rates applicable for April 2016.

State tax - The general sales tax rate for most tangible personal property and taxable services is 7. General Corporation Tax GCT Unincorporated Business Tax UBT Banking Corporation Tax BCT Business Corporation Tax. For annual income that was above the cut-off point in that higher bracket the marginal tax rate in 2016 was 396.

Dividend tax rates The tax you pay depends on which Income Tax bands your dividends are in. Tax Assessor-Collectors Office Surpasses One Million Automobile Credit Card Transactions. According to learned counsel the department had complete knowledge of providing goods transport agency service GTA by the appellant way back in the year 2016 itself when the department issued a letter dated 2912016 to the appellant on the basis of information received from the Income Tax Department asking for the information of gross receipts for the FY.

2 It shall come into force on such date as the Central Government may by notification in the Official Gazette appoint and different dates may be appointed for different provisions of this Act and any reference in any such provision to the commencement of this Act shall be. For Filing ST-3 returns for Half Year Oct-Mar 2015-2016 08-04-2016. The 24-month average segment rates.

There were different rules for tax on dividends before 6 April 2016. The President of India also gave assent. The rate of withholding tax on a PAIF distribution interest is the same as that for a property income dividend for example 15 except where shown otherwise in.

To 1000 pm Pacific time due to scheduled maintenance. Updates for the corporate bond weighted average interest rate for plan years beginning in April 2016. In April 2020 the UK Government switched the CO2 figures used to calculate tax rates from the old NEDC data to the current WLTP figures.

Request for Transcript of Tax Return Form W-4. The 2016 CVA has since been extended to the 2021 2022 and 2023 property tax years. This article gives you the tax rates and related numbers that you will need to prepare your 2016 income tax return.

IRS Tax Brackets Deduction Amounts for Tax Year 2016. State single article - 275 on any single item sold in excess of 1600 but not more than 3200. Rates listed by city or village and Zip code.

This document is not a statement required to be published in the Indiana Register under IC 422--7-7. Revised Hawaii County Fuel Tax Rate Effective July 1 2019. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

120000- then in such case if payment is made within 30 days then amount of penalty would. Notice 2016-33 2016-22 IRB. However under IC -25-35-15 the department is required to publish the gasoline use tax rate on the 6 departments Internet website in a Departmental Notice.

If Service Tax liability determined by Central Exercise Officer is Rs. Rajya Sabha then passed 4 supplementary GST Bills and the new tax regime implemented on 1st July 2017. GASOLINE USE TAX RATE.

Rates listed by county and transit authority. The funding transitional segment rates applicable for April 2016. In 2017 the passing of 4 supplementary GST Bills in Lok Sabha as well as the approval of the same by the Cabinet.

In general 2016 individual tax returns are due by Monday April 17 2017. 2021 tax brackets taxes due April 2022 or October 2022 with an extension Tax rate Single Head of household Married filing jointly or qualifying widow Married filing separately. Please contact the local office nearest you.

Download XML Schema for ST3 Return V15 06-04-2016 Download ST3 Return Excel Utility V16 For filing ST-3 Returns for Half Year Apr-Sept 2016-2017 onwards 01-10-2016. 100000- then subsequently in appeal made the Service Tax determined by the Commissioner Appeals was Rs. Tax rate and revenues.

We apologize for any inconvenience. Anticipated Rental Motor Vehicle Surcharge Tax rate change to 5day effective July 1 2019. The 24-month average segment rates.

For questions about filing. From April 2016 the new Personal Savings Allowance means that basic rate taxpayers will not have to pay tax on the first 1000 of savings income they receive and higher rate taxpayers will. 2nd Quarter effective April 1 2016 - June 30 2016.

As such there was a change-over period where two different sets of BIK rates were used - one for vehicles registered before 6th April 2020 and one for those registered after that date. 115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate and repealed the corporate alternative minimum tax AMT effective for tax years beginning after December 31 2017. Please note that a vehicles BIK rate will therefore depend.

Employees Withholding Certificate Form 941.

Rbi Kept Repo Rate Unchanged At 6 25 Per Cent Http Taxguru In Rbi Rbi Kept Repo Rate Unchanged At 6 25 Per Cent Html Indirect Tax Rate Corporate Law

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

The Annual Subscription Limit For Individual Savings Accounts Isas Will Rise To 20 000 For 2017 18 From 15 240 I Accounting Services Accounting Trust Fund

Due Dates Of Income Tax Returns Tds Tcs Advance Tax Issue Of Tds Certificate For F Y 2016 17 Accounting Taxati Income Tax Return Income Tax Tax Return

Long Term Capital Gain Tax Rate For 2018 19 Capital Gain Capital Gains Tax What Is Capital

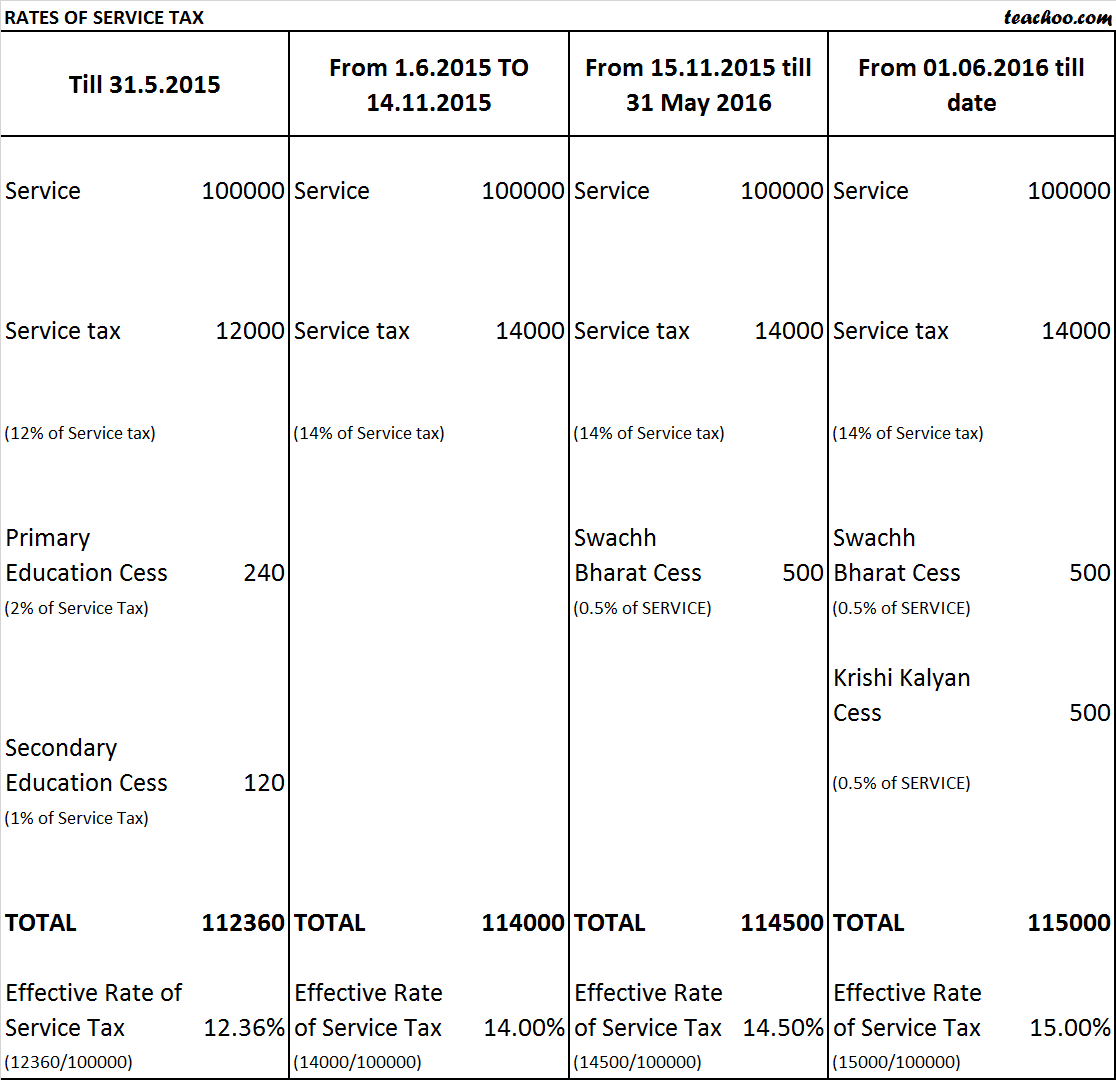

What Is The Rate Of Service Tax For 2015 16 And 2016 17

Pin By Ad Shekar On Gst India Goods And Services Tax Goods And Service Tax Goods And Services Indirect Tax